- Home

- News & Insights

- Industrial Tech Valuation update May 2022

Industrial Tech Valuation update May 2022

Industrial Technology Overview

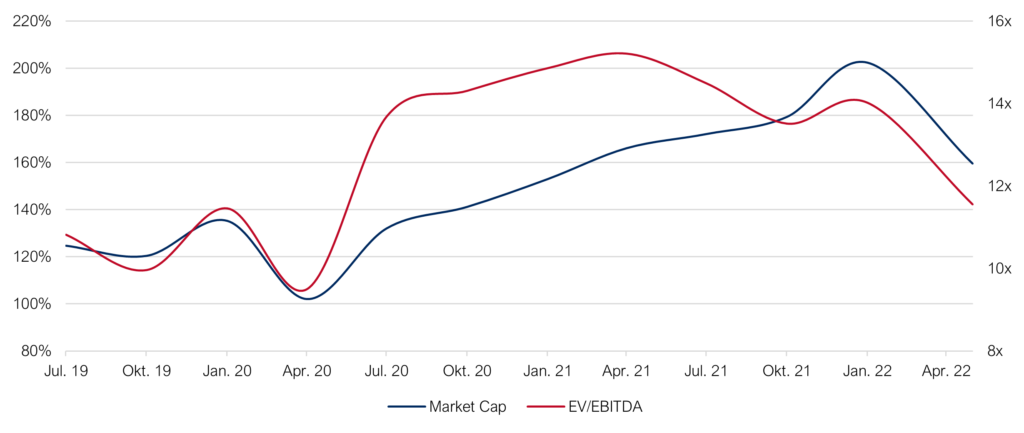

DEVELOPMENT MARKET CAPITALIZATION & EV/EBITDA

Industrial Technology Index falls 16% since record high in Jan. 2022 – Main factors:

- War in Ukraine

- Ongoing covid pandemic, resulting in limited availability of goods and global supply chain disruptions

- Cost increases (material & energy) – can only be passed through partially / with delay

- Interest rate hikes (announced in USA & expected in EU), compare also inflation

EV/EBITDA Multiple over 3 months down from 14.0x to 12.2x – Main factors:

- -16% Equity values Multiple impact: Down

- +5% Net Debt Multiple impact: Up

- +3% EBITDA Multiple impact: Down

Falling valuations hit entire economy (period Jan. – May 2022):

- -15% Dax 40

- -21% TecDax

- -16% MDax

- -18% SDax

- -13% Euro STOXX 50

- -13% S&P 500

Industry / technology companies thus equally affected – despite dependence on capital investment.

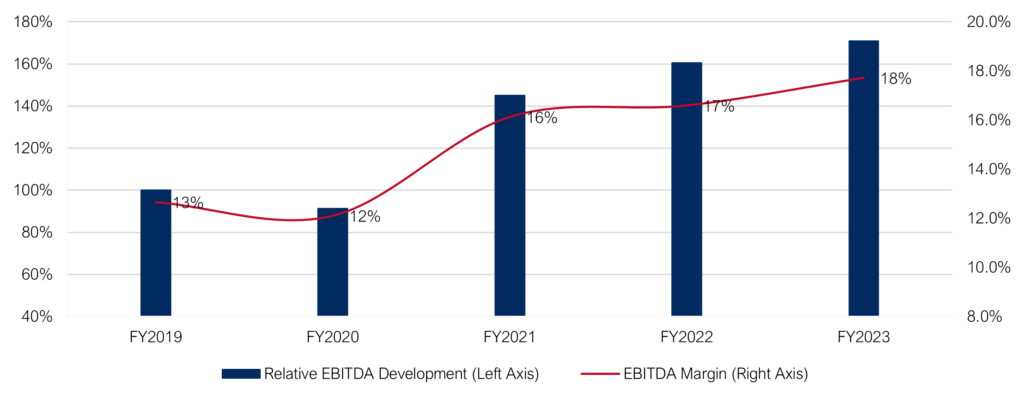

Outlook EBITDA Industrial Technology Index

Outlook positive (forecast):

EBITDAs generated in absolute terms increase favorably until 2023 (+10% p.a.):

- Rising revenues (+6% p.a.)

- Rising profitability (EBITDA margin: 16-18%)

Key question: To what extent have the above-mentioned negative factors already been considered, have the outlooks been updated and what are the underlying scenarios?

Current Issues & Outlook:

In the short term, current developments are weighing heavily on the market, and we can only speculate about a quick recovery. The outcome of the escalating situation in Ukraine is unclear, with increasing involvement of the Western world (e.g., USA $33MRD) there are 3 main scenarios:

- Hope for early calm (Diplomatic solution)

- Long-term dragging of the conflict (Ukraine resists Western support)

- Further, international escalation (Russia reacts against the Western supporting nations)

The current short/medium-term trend (on the stock markets) is pointing downwards.

Despite these (hopefully) short-term challenges, the Capitalmind Investec industry team believes that the medium- to long-term upside potential of the industrial tech sector remains considerable.

Fundamental growth drivers of innovative industrial companies remain intact and are gaining in importance as investments are increasingly driven by, among others:

- ESG-aspects, such as energy efficiency

- Just-in-time / „Same Day“ requirements of the end markets

- Cost – efficient production in DE / EU (technology / automation – supported)

- Networking of the value chain across the entire company & with partners (PLC to ERP)

ANNEX:

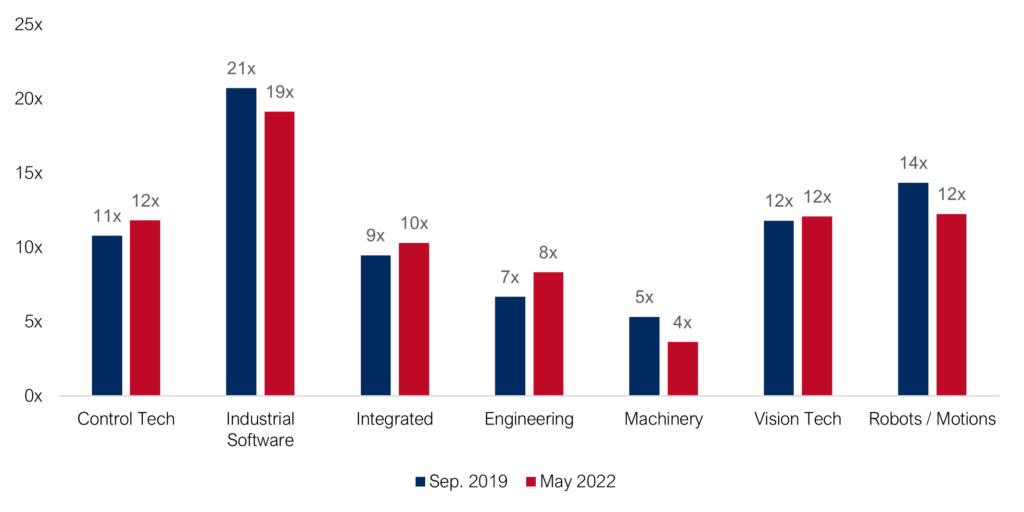

EBITDA-multiples by sub-sector: Sep. 2019 (Pre-Covid) – May 2022

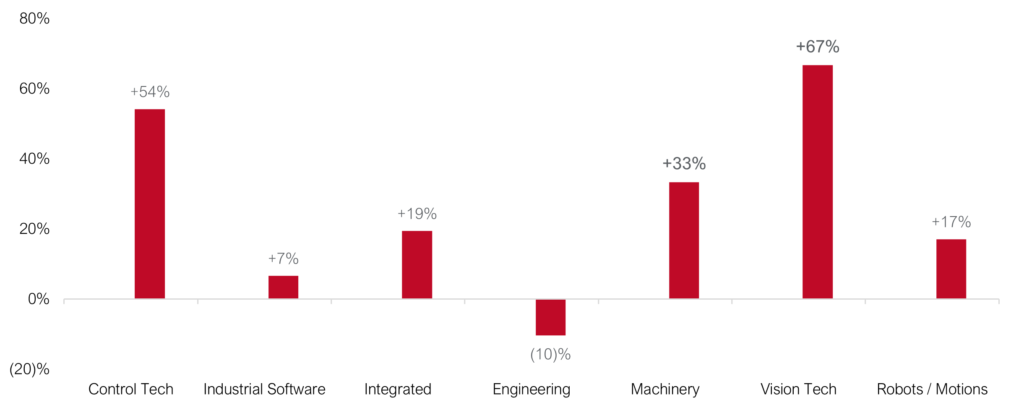

Development of market capitalization by sub-sector: Sep. 2019 – May 2022 (+27%)

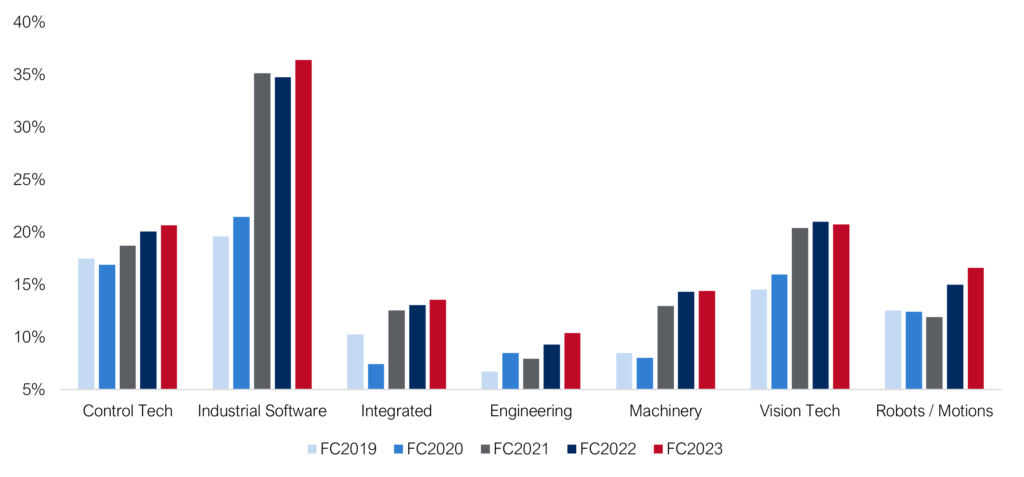

EBITDA-margin by sector from 2019 to 2023 (in %):

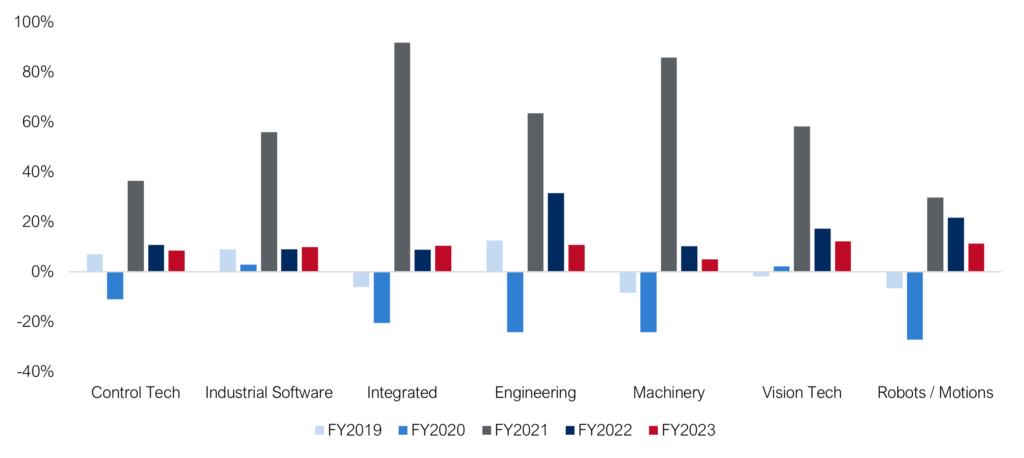

EBITDA growth by sector from 2019 to 2023 (in %):

Capitalmind Investec & Industrial Technology

The Capitalmind Investec Industrial Technology index tracks daily developments in sectors such as Control Tech, Industrial Software, Integrated Providers, Engineering, Machinery, Vision Tech & Robots/Motions.

The index includes valuations, growth projections, profitability margins and other metrics.

Would you like to learn more about valuations, buyer activity and current opportunities in the market?

Please do not hesitate to contact us.

You can find more information on our website at https://staging-o.capitalmind.com/industrials/