- Home

- News & Insights

- Company succession in 3-5 years?

Company succession in 3-5 years?

What needs to be considered?

SUCCESS FACTORS

Plan your succession

Succession is one of the most important decisions in the life of an entrepreneur. It requires time, careful preparation and a clear plan.

The handover plan

Define clear goals: measure the extent to which you are financially and mentally ready for the exit and develop an understanding of the value of the chosen succession option.

A transferable company

Create a business model that works without you. This way you will find the best buyer and achieve the highest valuation.

Advisor

Choose advisors with industry expertise who have access to potential buyers worldwide and can implement all transaction options.

Prepare yourself! No success without preparation

PERSONAL READINESS?

Some entrepreneurs want to continue working in the company, others don’t. How involved are you in the day-to-day business? How do you want to spend your free time after you leave? Can you let go?

Which interests are particularly important to you?

- Continued existence as an independent company

- Long-term and sustainable solution, especially with regard to a secure future for employees

- Financing necessary investments in technology, process efficiency, etc.

- Securing the company’s own asset position and realising the true value of the company

- Handing over the life’s work

- Supply security for family members

- Preservation of reputation as a good owner after the sale

FINANCIAL STATUS?

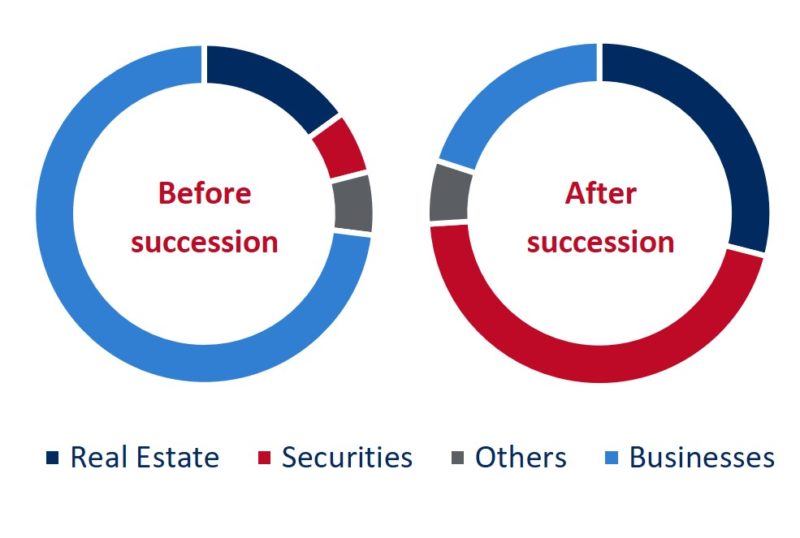

Entrepreneurs often have a lot of net assets tied up in the company and also like to overestimate the value of their own life’s work. Here it is not always easy, but it always makes sense to be objective.

Diversify your assets, create liquidity

We observe that the value of an active entrepreneur’s own company often corresponds to over 70 percent of his total assets. Other defenses such as shareholder loans, personal liabilities for company loans and rental income from real estate are additionally observable. The lack of diversification, liquidity and dependence on one’s own labour and health represent a risk to be considered with increasing age.

See value gaps in good time

Is it really realistic that in the last stage of your career you create growth in your company that you never managed? Often we hear I’m restructuring sales, I have a great idea, sometimes it works. But often we see entrepreneurs who at the same time take 50 days of holiday that is well deserved, need dividends, take high salaries for lifestyle etc. That doesn’t fit with the desired increase in value. What do you want?

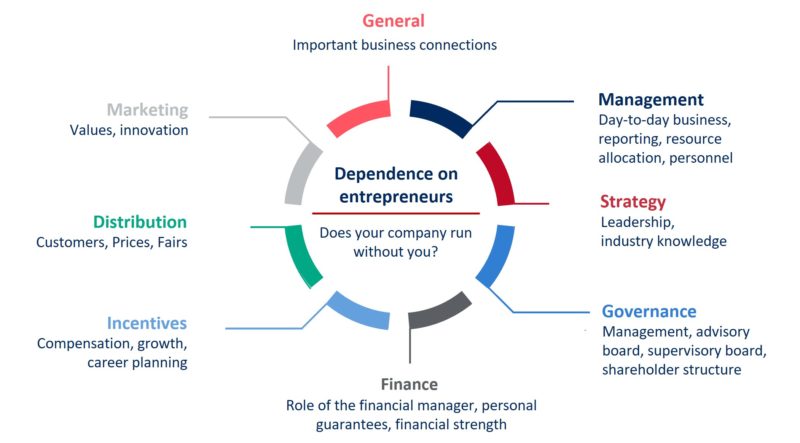

COMPANY TRANSFERABLE?

Medium-sized companies are often strongly influenced by their owners. They are also often the bearers of know-how, have decisive contacts to customers and suppliers and are the person of trust towards the employees. They are the contact person for all major problems.

Transferability checklist

Successful successions require clarity. Often, both outside management and essential second-level functions are missing. However, it is often difficult to incentivize the right managers alone.

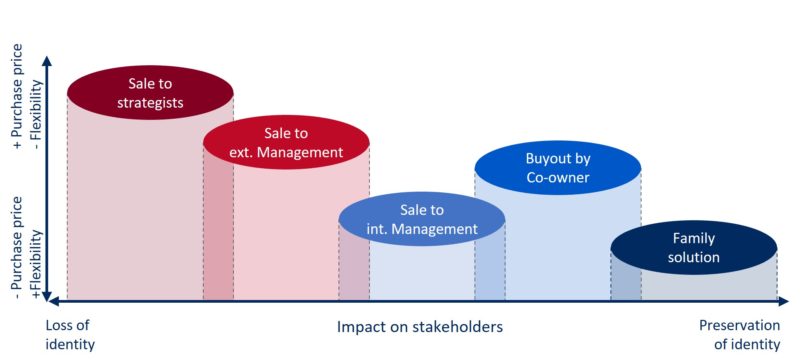

CHOOSE SUCCESSION SOLUTION

Who you transfer the company to depends on many factors that you should realistically assess before you initiate a process. It is important to do this in an unbiased way and not to follow any “beliefs”, such as the strategist is good, the financial investor is bad, and so on. All options should be considered realistically in relation to the achievement of objectives.

Succession solutions define various advantages and disadvantages

CAPITALMIND HAS MANY YEARS OF EXPERIENCE AND CUSTOMER RELATIONSHIPS

Would you like to learn more? Please feel free to contact us.

Ervin Schellenberg, Managing Partner: ervin.schellenberg@capitalmind.com