- Home

- Publications & Actualités

- Industrial Tech Valuation Update 2016 – 2021

Industrial Tech Valuation Update 2016 – 2021

Industrial Technology Overview

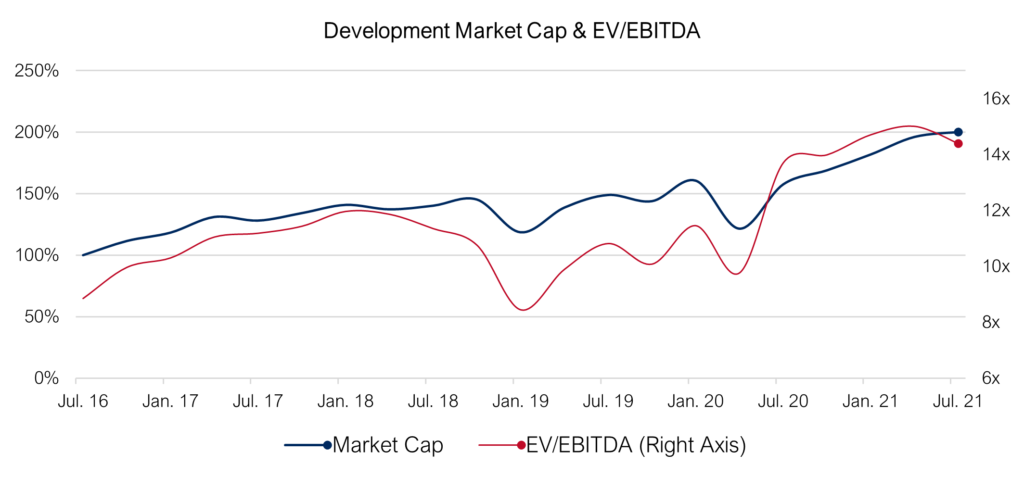

More than a year after the widespread outbreak of the Corona pandemic in Germany, the Industrial Technology Index is stabilising at a record level. The total value (market capitalisation) of the companies included in the index was around 25 percent higher than the pre-Covid level as of the cut-off date on 1 July 2021. Over a five-year period, the total value doubled.

This robust performance is based on macroeconomic factors, such as the ongoing low interest rate environment and comprehensive Covid aid packages, as well as strong growth in China and sector-specific growth drivers that have become increasingly important due to the pandemic.

Despite the strong performance, which represents a 40% outperformance to the DAX30 over the five-year period, Capitalmind Investec still sees significant upside potential. In particular, the pandemic is acting as a catalyst to confirm that the continuation of digitalisation and automation is a growth driver. Inflation fears and a volatile interest rate environment have not been able to have a significant negative impact so far.

At an average of 14.4x EBITDA, valuations are currently 25% higher than at the beginning of 2020.

Multiples and market capitalisations are currently diverging for the first time after a largely synchronous course during the pandemic period. While market capitalisations remain at record levels, multiples have fallen for the first time since the Covid price crash.

Valuation drivers:

The terms « Industry 4.0 » and « IoT » are being filled with life – real automation (« lights out ») and collaboration (human & machine) are emerging.

Replacing adaptive and flexible manual processes first requires the mechanisation of human perception: optical, acoustic etc. for all areas such as presence, movement, haptics, temperature etc.. Based on this, machines can act.

In this environment, sustainable business models emerge and providers find specific and lucrative niches.

Following the demand, companies that offer integral total solutions with a focus on special applications or sector-agnostic applicable technologies profit.

Integration into digital corporate landscapes (entire ERP instead of « only » MES) and interlinking across the entire value chain (development, marketing, manufacturing and delivery) are replacing the demand for « island machines » that are as fast as possible.

Companies that offer these holistic solutions benefit from strong operating business and high investor interest at attractive valuations.

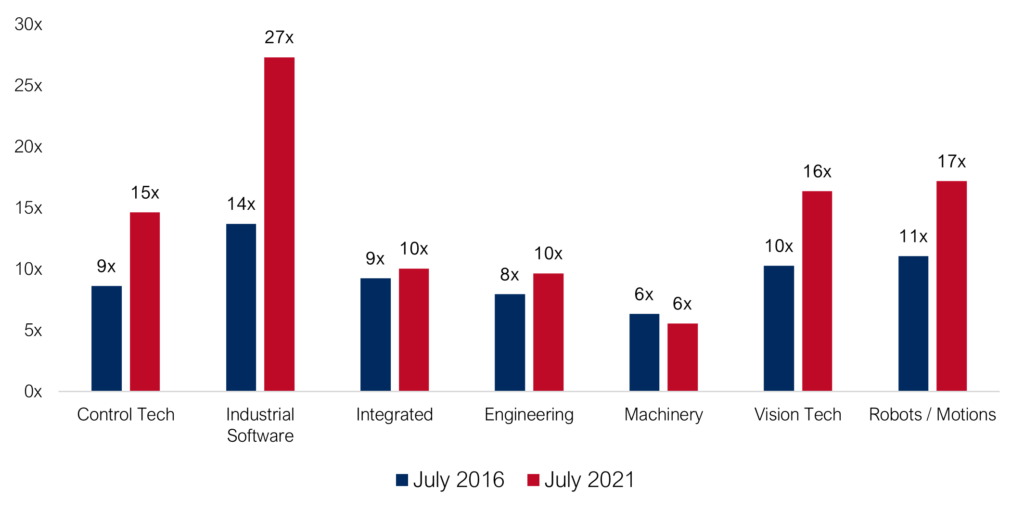

EBITDA multiples by sector (index 9x & 14x):

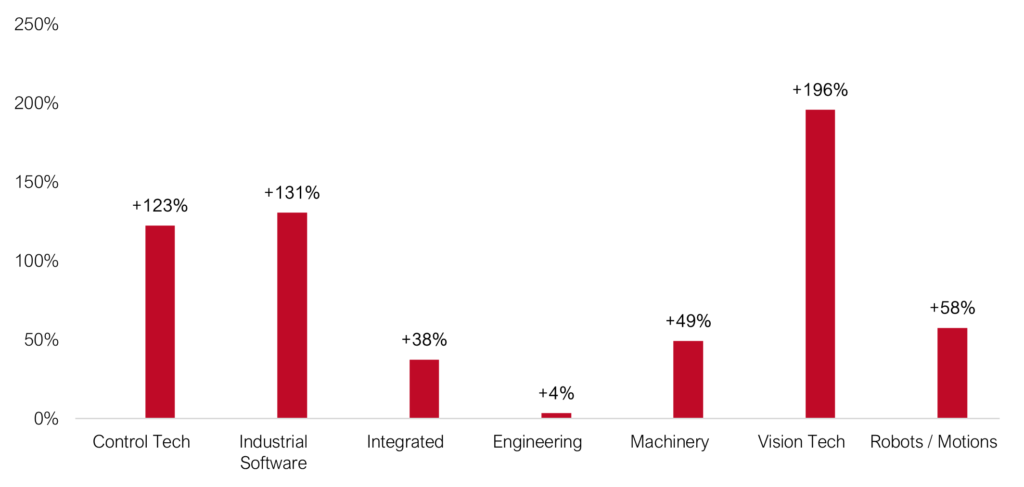

Development of market capitalisation by sector:

July 2016 – July 2021 (Index +100%):

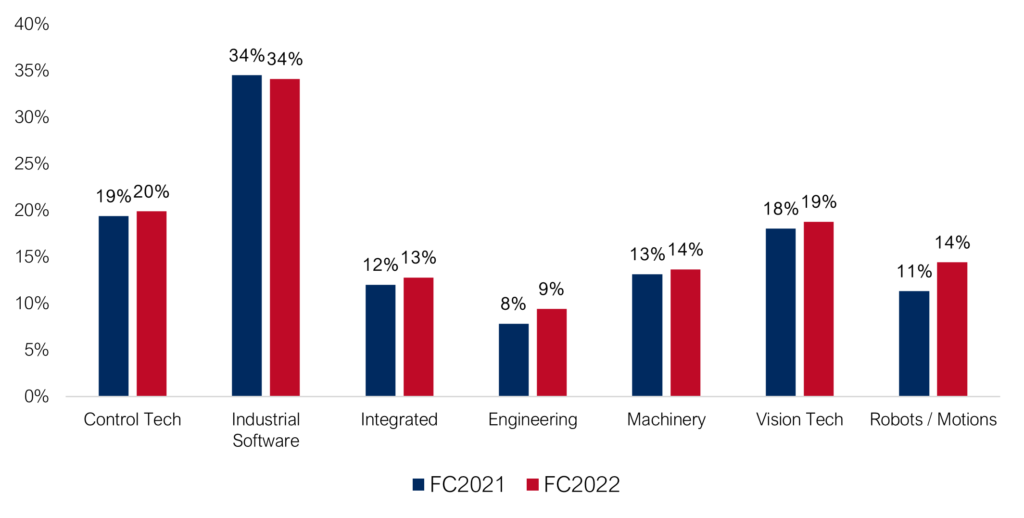

EBITDA margin by sector 2021 & 2022 (index 15% & 16%):

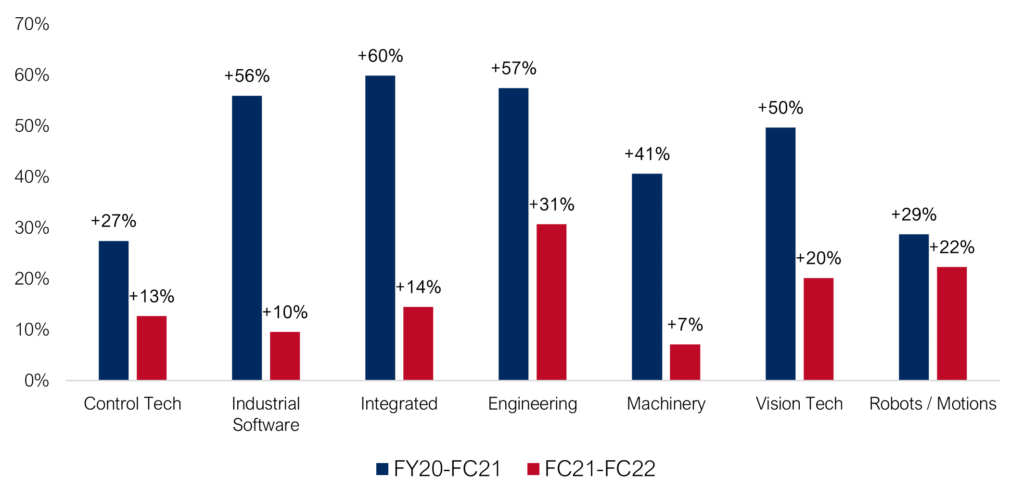

EBITDA growth by sector 2020/21 & 2021/22 (index +41% & +15%):

Capitalmind Investec & Industrial Technology

The Capitalmind Investec Industrial Technology Index tracks daily developments in sectors such as Control Tech, Industrial Software, Integrated Providers, Engineering, Machinery, Vision Tech & Robots/Motions.

The index includes valuations, growth projections, profitability margins and other metrics.

Would you like to learn more about valuations, buyer activity and current opportunities in the market?

Feel free to contact us.

You can find more information on our website at https://staging-o.capitalmind.com/industrials/