- Home

- News & Insights

- M&A in the rental market | Rental Blog

M&A in the rental market | Rental Blog

Catching up from our latest insight, the European rental market continued the growing trend and experienced significant consolidating M&A activity. The market is experiencing increased interest of private equity and infrastructure funds looking to benefit from the cost-advantages a rental platform has to offer.

The European Rental Association (ERA) recently highlighted a significant, 7.9% growth in the European rental sector during 2021. This surge resulted in a rental turnover exceeding € 24.6 bn across the 15 European countries specified in the report. All markets experienced growth, with the UK, Germany, and France dominating, collectively accounting for approximately 60% of the entire European rental market (which is supported by our transaction analysis below). The Dutch rental market grew with 7.2% between 2021 and 2022.

Recently, the rental industry is undergoing a shift to more technological solutions and environmentally friendly business models, opening opportunities for companies to strategically leverage on these developments and stay at the forefront of the market trends.

Consolidation analysis

There has been considerable M&A activity in the Rental industry with average EBITDA multiples in the past three years averaging around 7.7x. The strongly growing market combined with the scalability, recurring nature and diversification of solutions are driving margins.

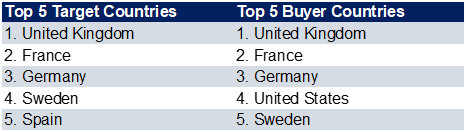

We analysed 463 European transactions from the beginning of 2018 until mid-2023. The top 5 target and buyer countries are in line with the findings of the European Rental Association, with the UK, France and Germany being both the most popular target and buyer countries in Europe.

Furthermore, we found that in total, 48% of the transactions are cross-border acquisitions and in 75% of the time it is a strategic acquisition. Leading consolidators include the French company Kiloutou, United Kingdom’s Sunbelt Rentals and Briggs Equipment, Finnish RentaGroup, Greek Eltrak, Dutch Boels, and Swedish Atlas Copco.

Main factors for rental companies to consolidate are portfolio diversification, the acquisition of new technology and cost savings. In general, a larger scaled company typically has the capacity to offer more competitive prices, a broader selection of equipment, and superior customer service compared to their smaller counterparts.

Increased interest from financial buyers (PE / Infrafunds)

The market is also experiencing increased interest from financial buyers, multiple private equity and infrastructure funds that are invested in an equipment rental company. Since 2018, 25% of the total amount of transactions in the European rental industry include involvement of a financial investor.

Key reasons why rental companies are becoming increasingly attractive to infrastructure- and private equity funds include:

• Interesting return pattern; investments in the sector have a short payback period and high ROI because the acquired equipment continuously generates revenue.

• The sector has a lower risk nature due to high asset value and controllable cashflows in an economic downturn. Capital expenditures can easily be lowered by delaying the expansion of new equipment. Assets usually have good residual value.

• Infrastructure funds have always had a preference for investments in asset heavy companies. In the past, only ‘core’ assets were considered, such as utility providers or air- and seaports. Nowadays data centres, stadiums, hospitals and rental companies are of increased interest.

• The rental industry is also seeing increased interest from impact investors focussed on sustainable investments, due to the circular nature of equipment rental activities.

As a result of these factors, the equipment rental market is expected to continue to consolidate in the years to come. This will likely lead to a smaller number of larger, more dominant players in the market.

Sources: S&P500 CapitalIQ, European Rental Association (ERA)