- Home

- News & Insights

- High degree of M&A in software recently

High degree of M&A in software recently

M&A in software (as a service)

In recent years, we have seen much M&A in software (as a service). This is due to a mix of Software companies acquiring both (i) functionality and (ii) geographic / customer presence. On top of that, there are notably more buyers due to more active private equity and / or venture capital investors. Both investor types are nowadays executing so called ‘Buy & Build’ strategies.

What particularly struck our attention is the increasing international nature of Software transactions. In our analysis of over 400 Software transactions executed in the past 4 years shows that 58% of the transactions are cross-border. For 2019 this number even stands as high as 68%(!). The picture below shows the geographic locations of buyers that acquire targets headquartered in Europe.

Source: S&P Capital IQ

Larger software M&A transactions have higher valuations

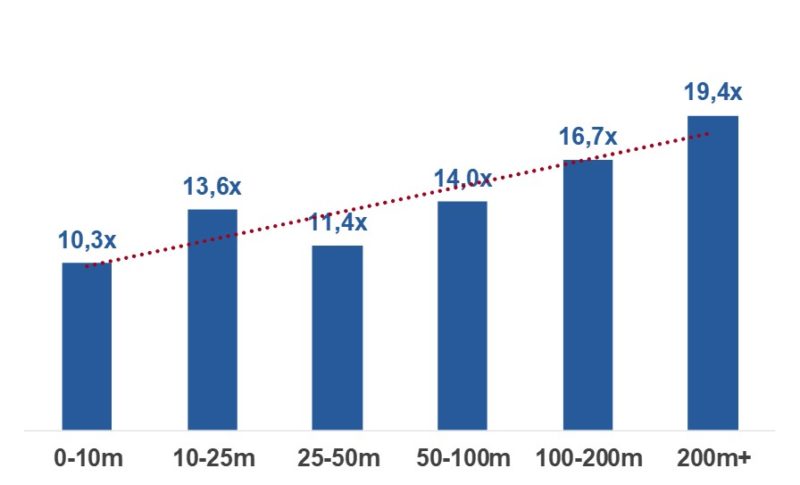

During our analysis of the transaction landscape we also looked at valuations. Similar to what we see in other industries, that larger transactions have higher valuations than smaller transactions. As the table below shows, EBITDA to Enterprise Value multiples, show a correlation with the size of the transaction.

Oddly enough, there also always appears to be a peak at a certain valuation point. In our view (and experience) this point indicates where most demand is. In this particular case, this size preference could be related to ideal ’ticket’ sizes for private equity companies active in the software market. However, in the end the largest transactions get the highest multiples. Most likely because such deals are more scarce and attract a larger pool of (global) buyers. Private equity is clearly attracted to the sector: it pays off for to build larger software companies by buying (multiple) smaller, cheaper companies.

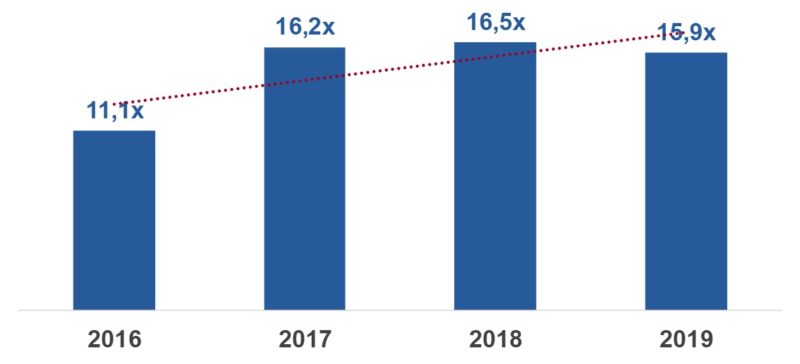

In the end key drivers for the valuation is probably the solid economic growth of the global economy between 2016 and 2019. So far, valuations peaked in 2018 and considering the current corona crisis, valuations are likely to come down. Software industry valuations are highly influenced by a number of factors including:

- is the business model scalable (internationally);

- how recurring are the revenue streams;

- costs for attracting a new customers;

- limit gross customer churn.

Our database lacks this level of granularity and therefore doesn’t discriminate for these elements.

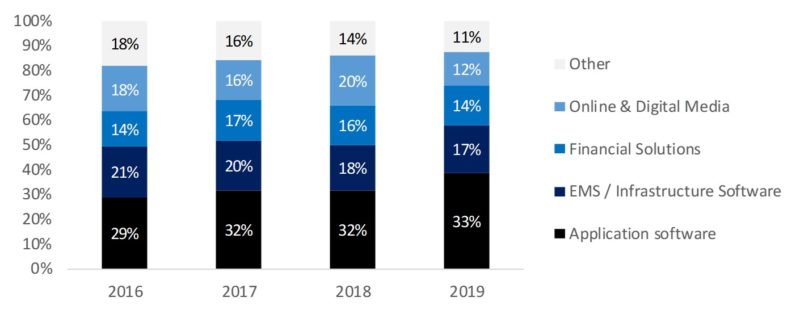

Majority of software M&A transactions are in the application software space

When we zoom in on the targets per Software sub-segment, we see that the vast majority of M&A in software is within the Application Software space. This category, that aims to optimize software companies’ clients operational activities includes ERP, SCM, HR, BI and Engineering software.

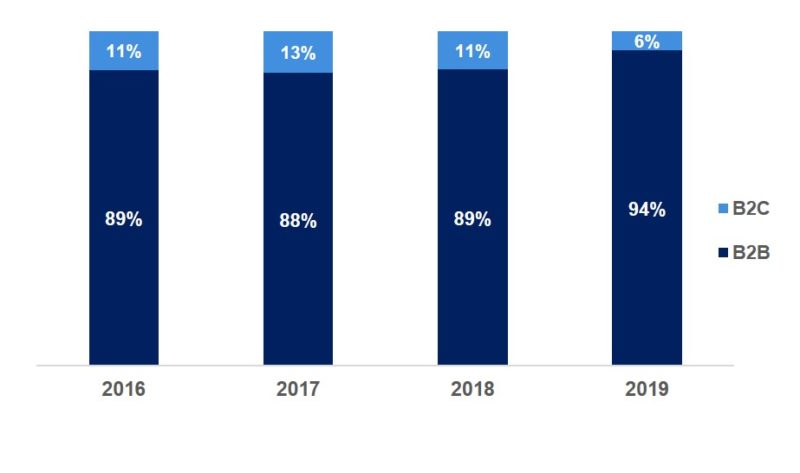

Buyers also prefer B2B Software companies over B2C. This is quite obvious since Application Software is predominantly B2B. Already in 2016 B2B represented 89% of all the transactions. Due to strong year-on-year growth, the segment represents 94% of the overall transactions in 2019.

Increase in Private Equity buyers in software M&A

Over the past years, we have seen a significant increase in M&A activity due to Buy & Build platforms. These platforms are often backed by Private Equity investors or a selected number of strategic (listed) companies. Two examples of such companies are TSS (owned by Constellation Software) and Visma (owned by private equity).

For the coming years, we expect an even stronger increase in number of transactions for software M&A due to:

- More private equity interest;

- Building size and subsequently enjoying scalability leads to higher valuations for the current owners;

- Expanding internationally to build a truly international label, which also leads to a higher valuation;

- Enhancing product / service offering.

Capitalmind Investec’s TMT sector team has developed more detailed research on M&A in Software. Should you wish to walk through our research or exchange thoughts, then please feel free to reach out.

* Analysis is based on Capitalmind Investec’s proprietary database (with input from S&P’s Capital IQ and further desk research), covering over 400 Software transactions from 2016 till 2019. No representation or warranty, express or implied, is made as to the accuracy, reasonableness or completeness of the database.