- Home

- News & Insights

- Inflation & interest rate increases: Impact on my enterprise value

Inflation & interest rate increases: Impact on my enterprise value

Company valuations in times of inflation and interest rate hikes

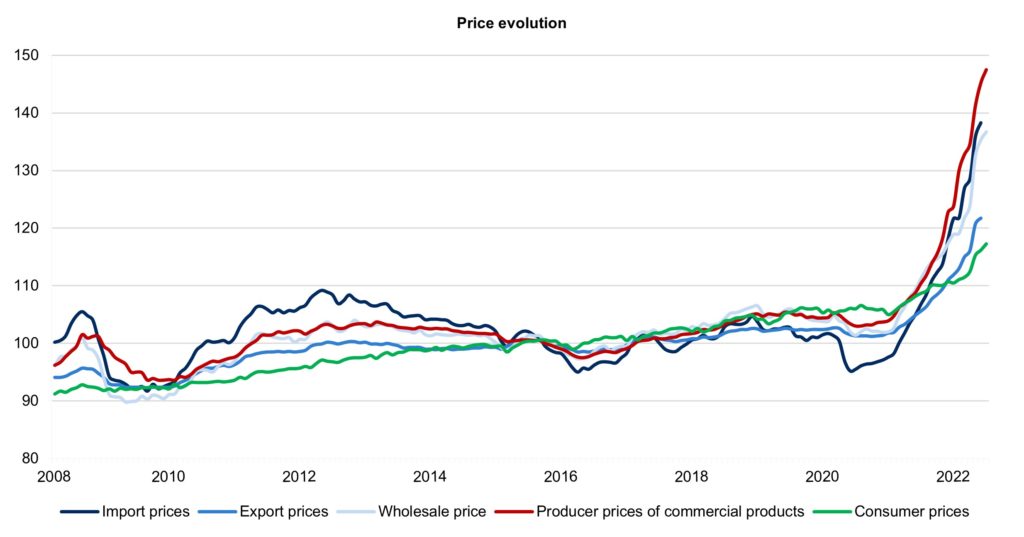

Price development 2008 – 2022

Inflation and no end in sight

- A large part of the global economy is affected by a supply shock.

- The reasons: Corona measures such as lockdowns in China, corona-related staff shortages, supply chain problems, etc.

- The Ukraine war is exacerbating shortages of some goods, partly due to sanctions. It has also had a lasting impact on energy policies in Europe – energy prices have risen steadily.

- The consequence: inflation rates are rising worldwide. In the EU, the inflation rate reached +7.9% in May 2022 compared to the same time last year.

- The end of the line has probably not yet been reached: Inflation of producer prices, wholesale prices and import prices reached new highs in May 2022. For example, producer prices rose by +33.6% year-on-year. Producer prices are considered a major indicator of consumer inflation.

Rising interest rates ahead

- The rapid rise in inflation rates is forcing central banks to act. The exit from an ultra-loose monetary policy is still sluggish in Europe, while it is already in full swing in the USA. But the ECB has also held out the prospect of interest rate hikes for the summer.

- Higher interest rates, the reduction or termination of bond purchases and the reduction of central bank balance sheets are intended to dampen inflation.

- At best, a wage-price spiral, which can already be guessed at from the demands of the trade unions, is to be prevented and price stability restored.

Influence of inflation on the enterprise value

- Company valuations are often based on performance indicators such as EBITDA or EBIT.

- Higher costs for input factors such as preliminary products, raw materials, and supplies, especially energy, as well as rising wages and salaries put pressure on the margins.

- If the increased costs cannot be passed on to customers through higher prices, this would have a negative effect on EBITDA or EBIT and thus also on the value of the company.

- This underlines the importance of “pricing strategies” in the current environment. Especially as the communication of price increases is currently very credible.

- If increased costs can be offset by price increases, the enterprise value can be kept stable, ceteris paribus.

Influence of rising interest rates on the enterprise value

- In addition to the performance indicators, the level of the performance multiple also plays a decisive role in company valuations, to put it simply.

- The multiples used in company valuations, e.g., enterprise value/EBITDA and enterprise value/Revenue, have tended to expand in recent years due to favorable interest rates.

- It can be assumed that these very multiples will contract, i.e., fall, when interest rates rise. This could already be observed in the first months of this year, e.g., also in falling stock market prices. See also, for example, the Industrial Technology Index of 11.05.2022.

Conclusion

- Supply is tight, inflation is at a new high and interest rates are likely to rise further. Company valuations could come under pressure on the earnings side and from contracting high valuation multiples.

- Although the current environment is challenging, there are some possible responses or solutions for entrepreneurs.

- For example, the effect of increased costs can be cushioned by pricing strategies.

- Valuation multiples, on the other hand, can be supported by clever acquisitions.

- Positioning in innovative future topics such as sustainability/ESG, technology, automation, etc. also tends to have a positive effect.

- Despite the increase in recent months, financing costs are still low from a historical perspective. In the current environment, company sellers can still make good succession arrangements and secure relatively high valuation levels.

- Vertical integration is also becoming more important again. Companies are already securing their independence through acquisitions in the energy sector, e.g., through stakes in wind farms.

Would you like to learn more about current valuations, buyer activity and current opportunities in the market?

Please feel free to contact us.