- Home

- News & Insights

- VisionTech update: innovation, valuation & inflation

VisionTech update: innovation, valuation & inflation

Backed by megatrend automation vision industry fights recession threat with innovation

Having collected fresh impressions on the 2022 VISION fair it’s only fair to state that the vision industry is well alive, introducing a variety of exciting new products, applications and technology, both from incumbent players as well as from start-ups. Apart from artificial intelligence powered vision another major application topic was (hyper) spectral imaging, which we already mentioned in one of the last Insights.

On the economical side the impacts of a multi-crisis ridden environment (pandemic, Ukraine war, component shortages, inflation/energy prices) leave their trace. However, backed by an ongoing strong order intake VDMA expects in 2022 a growth of 8% in sales (increased by +5% as estimated in early 2022) for the German machine vision industry, which is above the latest estimate for the overall Robotics + Automation sector (+6%) as well as the other two subsegments Integrated Assembly Solutions (+7%) and Robotics (+5%).

Despite short-term recession fears long-term growth perspectives are considered to be still highly attractive, based on ongoing digitization, increasing levels of automatization (in which vision applications are a key component) and high-quality demand in a more sustainable, high-tech production.

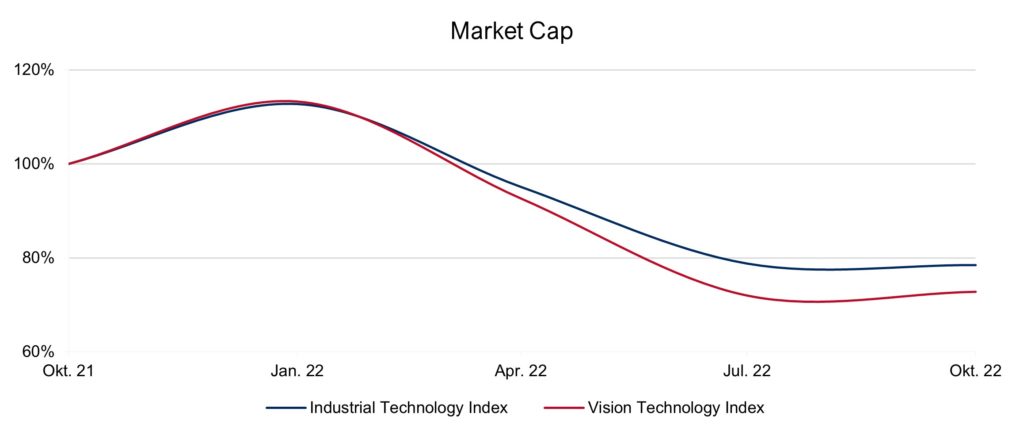

Looking at valuations, both our IndustrialTech and the VisionTech indexes reflect overall market development in terms of market cap since early 2022. Following the begin of the attack against Ukraine and increasing pressure on margins due to cost developments M&A sentiment has somehow slowed. Nevertheless, strategic rationales remain to be valid on many ends and we experience a continuous high level of buy-side interest both from strategic players as well as financial sponsors.

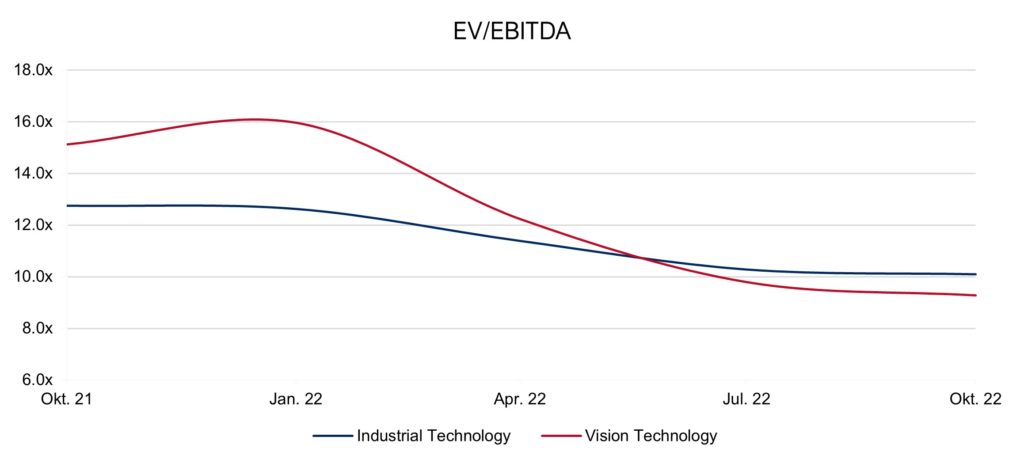

The trend observed at the end of the first half of the year with regard to EBITDA multiples has stabilized, i.e., vision tech companies apparently have suffered more compared to the overall industrial tech sector.

The trend observed at the end of the first half of the year with regard to EBITDA multiples has stabilized, i.e., vision tech companies apparently have suffered more compared to the overall industrial tech sector. Due to global developments already mentioned above, inflation has hit many of the large economies, leading to increased rates – close to 10% in the Eurozone compared to the same month in the previous year. The rapid rise in inflation rates is forcing central banks to act. The exit from an ultra-loose monetary policy has gained pace now in Europe as well: the ECB just announced a significant increase of interest rates for the second time in a row.

Due to global developments already mentioned above, inflation has hit many of the large economies, leading to increased rates – close to 10% in the Eurozone compared to the same month in the previous year. The rapid rise in inflation rates is forcing central banks to act. The exit from an ultra-loose monetary policy has gained pace now in Europe as well: the ECB just announced a significant increase of interest rates for the second time in a row.

Increased costs could have a negative effect on earnings and thus also on the company value. Low interest rates and monetary policy in general have contributed to the development of multiples used in business valuations, e.g., enterprise value/EBITDA and enterprise value/sales, have tended to rise in recent years. It can be assumed that these multiples will contract if interest rates increase – see above.

Even though the current environment is characterized by challenges, there are some response options or solutions for business owners. For example, the effect of increased costs can be mitigated through pricing strategies. Valuation multiples, on the other hand, could be supported by clever acquisitions. Positioning in innovative future topics such as sustainability/ESG, technology, automation, “softwarization” etc. also tends to have a positive effect. Financing costs are still relatively low from a historical perspective despite the latest increase. In the current environment, sellers of companies can still make good succession arrangements and secure attractive valuation levels.

The Capitalmind Investec Industrial Technology Index tracks daily developments in sectors such as Control Tech, Industrial Software, Integrated Providers, Engineering, Machinery, Vision Tech & Robots/Motions. The index includes valuations, growth projections, profitability margins and other metrics. You can find more information on our website at https://staging-o.capitalmind.com/industrials/

Capitalmind Investec has a senior sector team in Technology, who are experienced experts in selling, buying and financing businesses.

If you have questions and would like to know more about valuations, buyer activity and current opportunities in the market – please get in touch: arne.laarveld@capitalmind.com